Are you prepared for the digital transformation happening around you. The banking industry is undergoing a major transformation, driven by digital technology and innovation. This transformation, in the realm of mobile banking, is having a profound impact on the way people bank, and it is only going to accelerate in the years to come.

Digital Banking: A Revolution in Progress

The traditional brick-and-mortar bank is slowly becoming a thing of the past. In its place, a new era of digital banking is emerging. This new era is characterized by convenience, accessibility, and personalisation.

• Convenience: Digital banking makes it easy to manage your finances anytime, anywhere. You can check your balance, transfer money, and pay bills all from your smartphone or computer.

• Accessibility: Digital banking is available to everyone, regardless of where they live or their financial situation. You don’t need to go to a physical branch to access your banking services.

• Personalization: Digital banking can be customized to meet your individual needs. You can choose the features and services that are most important to you.

Key Trends Shaping the Future of Banking

There are a number of key trends that are shaping the future of banking. These include:

1. The rise of mobile banking: Mobile banking is already the preferred way for many people to bank. This trend is only going to continue as more and more people adopt smartphones and tablets.

2. The use of artificial intelligence (AI): AI is being used to automate tasks, personalize experiences, and improve security in banking. For example, AI can be used to detect fraud or recommend products and services to customers.

3• The growth of open banking: Open banking is a movement that allows customers to share their financial data with third-party providers. This is opening up new possibilities for innovation in banking, such as the development of new financial products and services.

4• The rise of crypto currency: Cryptocurrency, a form of digital or virtual currency secured by cryptography, operates independently without government or financial institution oversight. This innovative financial system is at a nascent stage but holds significant promise to revolutionize the traditional banking sector.

The Impact of Digital Transformation on Customers

Digital transformation is having a major impact on the way customers bank. I am sharing some of the benefits of digital banking for customers:

• Convenience: Digital banking makes it easy to manage your finances on your own time. You can do things like check your balance, transfer money, and pay bills without having to go to a physical branch.

• Accessibility: Digital banking is available to everyone, regardless of where they live or their financial situation. One can access his / her banking services from anywhere with just a smart phone and internet connection.

• Personalization: Digital banking can be customized to meet your individual needs. You can choose the features and services that are most important to you.

• Security: Digital banking is becoming increasingly secure, thanks to the use of technologies like encryption and biometrics.

• Education: Digital platforms provide educational resources to help customers make informed financial decisions.

How You Can Embrace Digital Banking

• Stay informed: Keep up with the latest banking technologies and trends so that you can make informed choices about your financial services.

• Use mobile banking: Explore your bank’s mobile app to take advantage of convenient features and services.

• Embrace fintech tools: Consider using fintech apps for budgeting, investing, or managing debts to optimize your financial life.

• Protect your data: Be vigilant about security. Use strong, unique passwords, enable two-factor authentication, and monitor your accounts regularly for unusual activity.

• Provide feedback: Engage with your bank to share feedback and suggestions for improving digital services.

The future of banking is digital.

The future of banking is increasingly digital, with technology playing a critical role in transforming the industry. By 2030, banks are expected to manage not only financial assets but also personal data, offering personalized services and greater financial inclusion through the digitization of money. Digital-only banks are gaining popularity, offering services at lower costs and greater convenience through the proliferation of digital technologies.

The help of digital technology allows banks to process transactions faster, reduce costs, and offer personalized services to customers. Traditional banks are being forced to adapt and embrace digital transformation to compete with these innovative digital institutions. Therefore, the future of banking is undeniably being revolutionized by the rise of digital banks, offering more convenient, secure, and customer-centric services at a lower cost

If you want to stay ahead of the curve, it’s important to embrace digital banking today.

Here are examples, within the context of mobile Banking and Digital Finance:

Mobile Banking Apps:

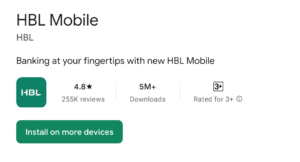

- Habib Bank Limited (HBL): HBL offers the HBL Mobile App, which allows users to check account balances,transfer funds, pay bills, apply for loan and more.

Habib Bank Limited (HBL) mobile app

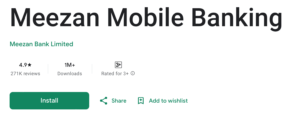

- Meezan Bank: Meezan Bank’s digital banking platform is called Meezan Mobile Banking. It offers similar features to HBL’s app, along with Islamic banking features.

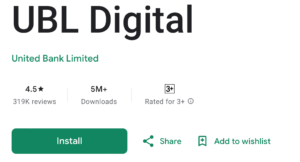

- United Bank Limited (UBL): UBL’s digital banking app is named UBL Digital. It boasts a user-friendly interface and allows for a wide range of transactions and services.

United Bank Limited (UBL) mobile app

- National Bank of Pakistan (NBP): NBP’s digital banking app is called NBP Digital. It offers basic banking features as well as some unique options like investing in NBP mutual funds.

National Bank of Pakistan (NBP) mobile app

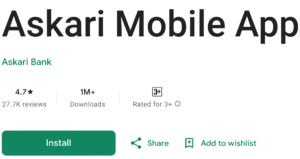

- Askari Bank Limited: Askari Bank’s digital banking platform is called Askari Mobile App. It provides features like account management, bill payments, and mobile top-ups.

Askari Bank Limited mobile app

Digital Wallets:

- PayPal: A widely used digital wallet that facilitates online payments and money transfers between users.

- Venmo: Popular among younger users, it offers easy money transfers between friends and family, with a social feed of transactions.

- Google Pay: Allows for contactless payments in stores, money transfers, and integration with other Google services.

- Apple Pay: Provides iPhone users with a secure way to make contactless payments, online purchases, and in-app buys.

- Samsung Pay: Offers a wide range of contactless payment options and is compatible with most payment terminals.

Cryptocurrency Wallets:

- Coinbase Wallet: A user-controlled cryptocurrency wallet, allowing users to buy, sell, transfer, and store cryptocurrencies.

- Blockchain Wallet: Offers a way to securely manage Bitcoin, Ether, and other cryptocurrencies, with robust security features.

- Trust Wallet: A mobile wallet app for Ethereum and other ERC20 and ERC223 tokens, emphasizing security and anonymity.

- Exodus: Provides a user-friendly interface for storing, managing, and exchanging multiple cryptocurrencies.

- MetaMask: A gateway to blockchain apps, available as a browser extension and mobile app, focusing on Ethereum and ERC tokens.

Investment Apps:

- Robinhood: Offers commission-free trading of stocks, ETFs, and cryptocurrencies, appealing to beginners and casual investors.

- Acorns: Rounds up purchases and invests the spare change into diversified portfolios, tailored for novice investors.

- E*TRADE: Offers trading platforms for stocks, options, and futures, catering to both beginners and advanced traders.

- TD Ameritrade Mobile: Provides robust trading tools, research, and educational resources for a wide range of investments.

- Fidelity: Offers online trading for stocks, ETFs, mutual funds, and retirement planning with comprehensive research tools.

Peer-to-Peer Payment Apps:

- Zelle: Offers a fast way to send and receive money directly between almost any bank accounts in the U.S., typically within minutes.

- Square Cash (Cash App): Allows users to send money to friends and family free of charge and invest in stocks or Bitcoin.

- Google Pay (for peer-to-peer payments): Enables users to send and receive money directly from their bank account or attached cards.

- Facebook Pay: Integrated within Facebook Messenger, this service facilitates sending money to friends, donations, and purchases within the Facebook ecosystem.

- Payoneer: Focuses on international transactions, offering cross-border payments for businesses and professionals.