Proprietary trading firms are redefining talent acquisition and risk management through an innovative model that merges evaluation with opportunity. Traditionally, proprietary trading, or “prop trading,” has allowed financial entities to engage directly in market activities using their own funds, thereby capitalising on market movements without the need for commissions or fees. This approach, while not new, has undergone significant evolution, especially with the advent of funded trader programs that leverage trading challenges as a vetting mechanism.

The Evaluation Process: A Gateway to Funded Trading

The journey to becoming a funded trader begins with an evaluation process, a novel yet increasingly popular approach among prop firms. This process typically unfolds as follows:

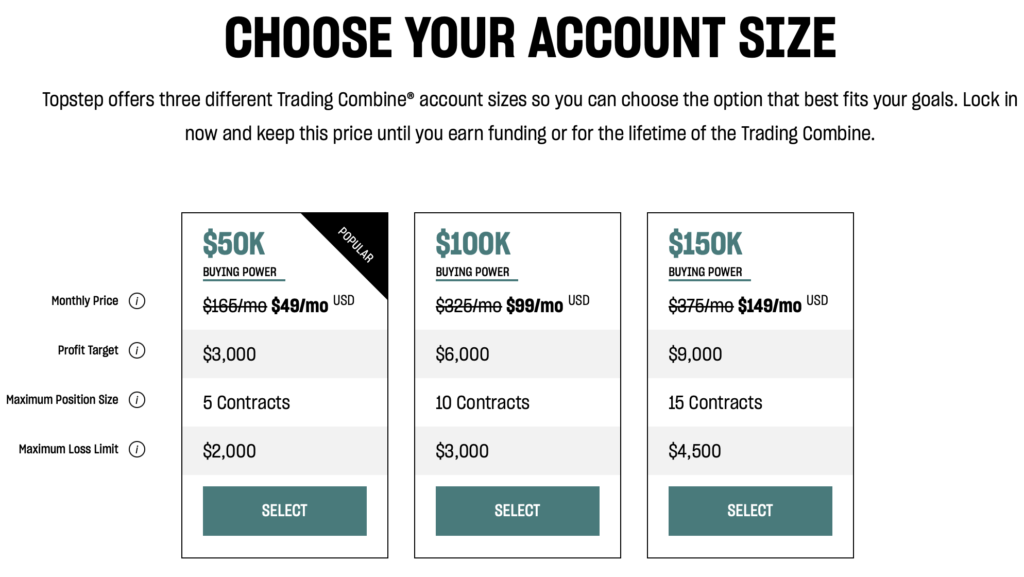

- Trading Challenges: Aspiring traders pay a fee to enter a challenge, where they trade within set guidelines, aiming to hit profit targets without breaching risk management protocols.

- Profit Targets and Rules: Each firm sets its criteria, including profit goals, loss limits, and sometimes restrictions on trading styles or hours.

- Simulation vs. Real Markets: Challenges may occur in simulated environments or live markets, testing traders’ skills under varied conditions.

Advancing to a Funded Account

Successful candidates who navigate the evaluation with skill and adherence to risk management are awarded a funded account, marking the start of a partnership where profits are shared between the trader and the firm. This model not only offers traders significant capital without the risk of personal financial loss but also ensures that only the most adept traders manage the firm’s resources.

The Importance of Risk Management

Risk management is a cornerstone of this model, with daily loss limits and maximum drawdown parameters are in place to safeguard against reckless trading. This disciplined approach ensures that both the firm’s and the trader’s interests are aligned towards sustainable profitability.

Advantages and Considerations

This model presents numerous advantages, such as lower risk for traders and a merit-based selection process. However, potential participants must consider the initial fees and the compatibility of their trading style with the firm’s guidelines.

A Growing Trend

The shift towards using trading challenges to screen for funded traders reflects a broader trend in the proprietary trading industry. This approach not only mitigates risk for the firms but also opens up unprecedented opportunities for skilled traders to manage significant capital, fostering a performance-driven environment that rewards talent and discipline.

Historical Context and Evolution

Prop trading’s roots are deep, with its formal recognition growing alongside the financial markets. The post-2008 landscape saw significant regulatory shifts, most notably in the U.S. with the Dodd-Frank Act, incorporating the Volcker Rule which led to the emergence of independent prop trading firms. These entities have adapted to regulatory constraints and market inefficiencies, leveraging technology and quantitative analysis to carve profitable niches.

The Future of Prop Trading

As the industry continues to evolve, prop trading firms are investing heavily in technology and compliance, ensuring their strategies meet regulatory standards while maximizing efficiency. The global footprint of these firms allows for a diverse and dynamic trading environment, presenting challenges and opportunities for traders worldwide.

Considerations for Aspiring Funded Traders

• Evaluation Pathways: Identifying a prop firm’s evaluation criteria involves reviewing their website for information on profit targets, trading rules, phase requirements, and associated fees.

• Financial Commitments: Some prop firms may forgo initial investments from traders, focusing instead on evaluation for potential funding.

• Earnings and Responsibilities: Traders often share in both profits and losses, fostering a high-stakes environment that is both rewarding and challenging.

• Educational Opportunities: Many firms offer training in market analysis, trading strategies, and technology use.

• Professional Landscape: The prop trading sphere is characterized by its competitive nature, high earnings potential, and the need for robust analytical and quantitative skills, often found in individuals with backgrounds in finance, mathematics, or engineering.

• High Earning Potential: Successful prop traders can earn significant profits, sharing in the success of their trading strategies.

• Rapid Career Advancement: Performance-driven culture allows for faster career progression compared to many other financial sector roles.

• Dynamic Work Environment: The fast-paced nature of trading provides continuous learning and the opportunity to develop a deep understanding of financial markets.

In conclusion, the rise of funded trader programs represents a significant shift in the proprietary trading landscape, offering a unique blend of opportunity, risk, and reward. For skilled traders, this model provides a pathway to managing substantial capital, promising not just financial gain but also the chance to shape the future of finance through innovation and expertise.

Funded Trading Prop Firms: A Guide to Your Next Trading Opportunity

| Company | Participation Fee | Platform | Markets |

| FTMO FTMO.com | €155 | Proprietary platform, basic tools | Forex, Futures |

| Surgetrader accelerated trader results Surgetrader.com | $2,500 – $6,500 | Proprietary platform, basic tools | Futures |

| Nextstepfunded.com | $ 440 – $2,150 | Third-party platforms (NinjaTrader, etc.) | FX, Metals, Oil, Indices and Stock CFDS |

| Trueforexfunds.com | €89 | Proprietary platform, | Forex |

| Funded Trading Plus fundedtradingplus.com | $499 | Third-party platforms (MetaTrader 4/5) | Forex, Indices, Commodities, Cryptocurrencies through two platforms: ThinkMarkets, EightCap, |

| Fidelcrest fidelcrest.com | Varies $1,299 | Proprietary platform, Advanced tools | Stocks, Options, Futures |

| Topstep Trader topstep.com | $149 Activation Fee | Proprietary platform, Advanced tools | Futures |

| Funded Elite https://fundedelite.com | Refundable fee $115 | Proprietary platform, Advanced tools | Futures |

Is The Funded Trader a prop firm?

What is a funded trader program?

How do prop trading firms raise money?

Founders’ Capital and Investments: Many firms begin with upfront investments from their founders, partners or individuals attracted to the firm’s strategies or model.

Profit Reinvestment: A portion of the profits generated from successful trades are often reinvested into the firm, expanding its trading capital pool.

External Funding: Some firms seek additional funding from venture capitalists, angel investors, or institutional investors who see potential in firms growth and trading strategies.

Funded Trader Program Fees: Firms offering funded trader programs may charge subscription, evaluation, or account maintenance fees, generating an additional revenue stream for their capital pool and operational needs.

Strategic Partnerships: Collaborations with financial institutions, software providers, or educational platforms can open doors to additional funding through sponsorships, shared revenue models, or even direct investments.